Picture 1 of 12

Picture 1 of 12

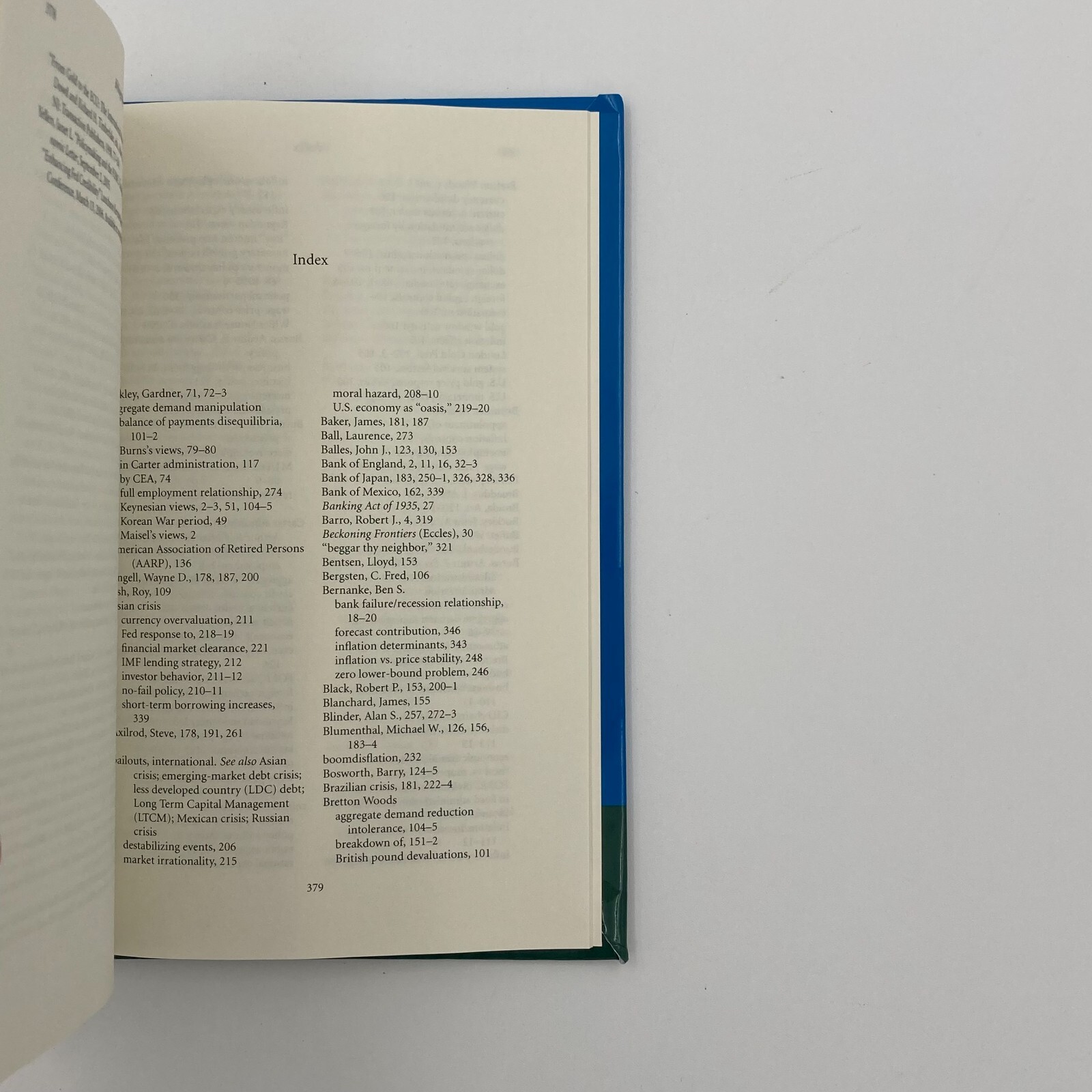

The Monetary Policy of the Federal Reserve A History By Robert L Hetzel HB New

US $71.95

or Best Offer

Was US $79.95 (10% off)

Condition:

Shipping:

Located in: Ellinger, Texas, United States

Delivery:

Estimated between Thu, Jun 27 and Sat, Jun 29 to 43230

Returns:

Payments:

Special financing available. See terms and apply now- for PayPal Credit, opens in a new window or tab

Earn up to 5x points when you use your eBay Mastercard®. Learn moreabout earning points with eBay Mastercard

Shop with confidence

Seller assumes all responsibility for this listing.

eBay item number:186398050682

Item specifics

- Condition

- Country/Region of Manufacture

- United States

- ISBN

- 9780521881326

- Subject Area

- Business & Economics, Political Science

- Publication Name

- Monetary Policy of the Federal Reserve : a History

- Publisher

- Cambridge University Press

- Item Length

- 9.2 in

- Subject

- Banks & Banking, Public Policy / Economic Policy, Money & Monetary Policy

- Publication Year

- 2008

- Series

- Studies in Macroeconomic History Ser.

- Type

- Textbook

- Format

- Hardcover

- Language

- English

- Item Height

- 1.1 in

- Item Weight

- 27.9 Oz

- Item Width

- 6.1 in

- Number of Pages

- 408 Pages

About this product

Product Information

The Monetary Policy of the Federal Reserve details the evolution of the monetary standard from the start of the Federal Reserve through the end of the Greenspan era. The book places that evolution in the context of the intellectual and political environment of the time. By understanding the fitful process of replacing a gold standard with a paper money standard, the conduct of monetary policy becomes a series of experiments useful for understanding the fundamental issues concerning money and prices. How did the recurrent monetary instability of the 20th century relate to the economic instability and to the associated political and social turbulence? After the detour in policy represented by FOMC chairmen Arthur Burns and G. William Miller, Paul Volcker and Alan Greenspan established the monetary standard originally foreshadowed by William McChesney Martin, who became chairman in 1951. Monetary Policy explains in a straightforward way the emergence and nature of the modern, inflation-targeting central bank.

Product Identifiers

Publisher

Cambridge University Press

ISBN-10

0521881323

ISBN-13

9780521881326

eBay Product ID (ePID)

63187560

Product Key Features

Number of Pages

408 Pages

Language

English

Publication Name

Monetary Policy of the Federal Reserve : a History

Publication Year

2008

Subject

Banks & Banking, Public Policy / Economic Policy, Money & Monetary Policy

Type

Textbook

Subject Area

Business & Economics, Political Science

Series

Studies in Macroeconomic History Ser.

Format

Hardcover

Dimensions

Item Height

1.1 in

Item Weight

27.9 Oz

Item Length

9.2 in

Item Width

6.1 in

Additional Product Features

LCCN

2007-023447

Dewey Edition

22

Reviews

"Hetzel's book deepens our understanding... of the entire story of this important period. It deserves a place on the bookshelf of every serious student of monetary history." - Christina D. Romer, Journal of Economic History, "Robert Hetzel's chronicle of the turning points in Federal Reserve conduct of monetary policy illuminates the problems that successive chairmen from William McChesney Martin on encountered in transforming the central bank into the modern Fed. Hetzel describes three monetary experiments beginning with a detour to the real bills doctrine, followed by decades of stop-go experience until the Paul Volcker-Alan Greenspan disinflation that ushered in a new monetary standard. Over time the Fed learned rule-like behavior that created expectations by the public of low stable inflation that is now the nominal anchor for a fiat money regime. It differentiates monetary policy as practiced before the 1980s from its practices since. Hetzel has written a path-breaking study." - Anna J. Schwartz, National Bureau of Economic Research, "An invaluable historical account of the history of U.S. monetary policy under the Federal Reserve System." - Robert G. King, Boston University, "Robert Hetzel's chronicle of the turning points in Federal Reserve conduct of monetary policy illuminates the problems that successive chairmen from William McChesney Martin on encountered in transforming the central bank into the modern Fed. Hetzel describes three monetary experiments beginning with a detour to the real bills doctrine, followed by decades of stop-go experience until the Paul Volcker-Alan Greenspan disinflation that ushered in a new monetary standard. Over time the Fed learned rule-like behavior that created expectations by the public of low stable inflation that is now the nominal anchor for a fiat money regime. It differentiates monetary policy as practiced before the 1980s from its practices since. Hetzel has written a path-breaking study." Anna J. Schwartz, National Bureau of Economic Research, "An invaluable historical account of the history of U.S. monetary policy under the Federal Reserve System." Robert G. King, Boston University, "The Monetary Policy of the Federal Reserve: A History by Robert Hetzel studies the evolution of monetary policy from the beginning of the Federal Reserve until the end of the Greenspan Era. The title claims the book is a history, and it is that, but it is much more. As a history, Hetzel's book details the conduct of monetary policy over nearly ninety years, and sets that conduct in the context of the intellectual and political environment of the time. As an economic synthesis, Hetzel's book views the evolution of monetary policies as a series of experiments useful for understanding fundamental issues concerning money, prices, and macroeconomic policy. The past serves as a laboratory for understanding the present. The emergence of modern monetary policy and prospects for our nation's financial future are understood by studying the learning-curve of the leaders of the Federal Reserve, the painful process of replacing the gold standard with a fiat money standard, and the recurrent monetary instability during the decades following the Second World War." - EH.net, 'The Monetary Policy of the Federal Reserve: A History by Robert Hetzel studies the evolution of monetary policy from the beginning of the Federal Reserve until the end of the Greenspan Era. The title claims the book is a history, and it is that, but it is much more. As a history, Hetzel's book details the conduct of monetary policy over nearly ninety years, and sets that conduct in the context of the intellectual and political environment of the time. As an economic synthesis, Hetzel's book views the evolution of monetary policies as a series of experiments useful for understanding fundamental issues concerning money, prices, and macroeconomic policy. The past serves as a laboratory for understanding the present. The emergence of modern monetary policy and prospects for our nation's financial future are understood by studying the learning-curve of the leaders of the Federal Reserve, the painful process of replacing the gold standard with a fiat money standard, and the recurrent monetary instability during the decades following the Second World War.' Gary Richardson, University of California in Irvine, 'Robert Hetzel's chronicle of the turning points in Federal Reserve conduct of monetary policy illuminates the problems that successive chairmen from William McChesney Martin on encountered in transforming the central bank into the modern Fed. Hetzel describes three monetary experiments beginning with a detour to the real bills doctrine, followed by decades of stop-go experience until the Paul Volcker-Alan Greenspan disinflation that ushered in a new monetary standard. Over time the Fed learned rule-like behavior that created expectations by the public of low stable inflation that is now the nominal anchor for a fiat money regime. It differentiates monetary policy as practiced before the 1980s from its practices since. Hetzel has written a path-breaking study.' Anna J. Schwartz, National Bureau of Economic Research, "The Monetary Policy of the Federal Reserve: A History is a comprehensive study of the evolution of monetary policy practiced by the Federal Reserve since its founding nearly a century ago. Hetzel brings a unique perspective to this material, a monetarist point of view rooted in his U of Chicago training, but a view profoundly influenced by an understanding of monetary policy in practice acquired as a life-long policy advisor at the Federal Reserve Bank of Richmond. The story is one of a nominal anchor for monetary policy lost with the collapse of the gold standard and found after decades of monetary turbulence in the priority that the Federal Reserve puts on low inflation and in anchoring inflation expectations. Hetzel enriches the story with remarkable insights about Federal Reserve behavior and with key insights from the modern New Neoclasscial Synthesis (New Keynesian) theory of monetary policy. This is an amazing story, one that Hetzel tells in great detail and with great enthusiasm." Marvin Goodfriend, Carnegie Mellon University, 'An invaluable historical account of the history of U.S. monetary policy under the Federal Reserve System.' Robert G. King, Boston University, 'The Monetary Policy of the Federal Reserve: A History is a comprehensive study of the evolution of monetary policy practiced by the Federal Reserve since its founding nearly a century ago. Hetzel brings a unique perspective to this material, a monetarist point of view rooted in his U of Chicago training, but a view profoundly influenced by an understanding of monetary policy in practice acquired as a life-long policy advisor at the Federal Reserve Bank of Richmond. The story is one of a nominal anchor for monetary policy lost with the collapse of the gold standard and found after decades of monetary turbulence in the priority that the Federal Reserve puts on low inflation and in anchoring inflation expectations. Hetzel enriches the story with remarkable insights about Federal Reserve behavior and with key insights from the modern New Neoclasscial Synthesis (New Keynesian) theory of monetary policy. This is an amazing story, one that Hetzel tells in great detail and with great enthusiasm.' Marvin Goodfriend, Carnegie Mellon University, "The Monetary Policy of the Federal Reserve: A History is a comprehensive study of the evolution of monetary policy practiced by the Federal Reserve since its founding nearly a century ago. Hetzel brings a unique perspective to this material, a monetarist point of view rooted in his U of Chicago training, but a view profoundly influenced by an understanding of monetary policy in practice acquired as a life-long policy advisor at the Federal Reserve Bank of Richmond. The story is one of a nominal anchor for monetary policy lost with the collapse of the gold standard and found after decades of monetary turbulence in the priority that the Federal Reserve puts on low inflation and in anchoring inflation expectations. Hetzel enriches the story with remarkable insights about Federal Reserve behavior and with key insights from the modern New Neoclasscial Synthesis (New Keynesian) theory of monetary policy. This is an amazing story, one that Hetzel tells in great detail and with great enthusiasm." - Marvin Goodfriend, Carnegie Mellon University, "The Monetary Policy of the Federal Reserve: A History by Robert Hetzel studies the evolution of monetary policy from the beginning of the Federal Reserve until the end of the Greenspan Era. The title claims the book is a history, and it is that, but it is much more. As a history, Hetzel's book details the conduct of monetary policy over nearly ninety years, and sets that conduct in the context of the intellectual and political environment of the time. As an economic synthesis, Hetzel's book views the evolution of monetary policies as a series of experiments useful for understanding fundamental issues concerning money, prices, and macroeconomic policy. The past serves as a laboratory for understanding the present. The emergence of modern monetary policy and prospects for our nation's financial future are understood by studying the learning-curve of the leaders of the Federal Reserve, the painful process of replacing the gold standard with a fiat money standard, and the recurrent monetary instability during the decades following the Second World War." - EH.netthe decades following the Second World War." - EH.netthe decades following the Second World War." - EH.netthe decades following the Second World War." - EH.net

Target Audience

Scholarly & Professional

Illustrated

Yes

Dewey Decimal

339.530973

Lc Classification Number

Hg2565 .H48 2008

Table of Content

Foreword: what is the monetary standard?; 1. The pragmatic evolution of the monetary standard; 2. Learning and policy ambiguity; 3. From gold to fiat money; 4. From World War II to the Accord; 5. Martin and lean-against-the-wind; 6. Inflation is a nonmonetary phenomenon; 7. The start of the great inflation; 8. Arthur Burns and Richard Nixon; 9. Bretton Woods; 10. Policy in the Ford administration; 11. Carter, Burns, and Miller; 12. The political economy of inflation; 13. The Volcker disinflation; 14. Monetary policy after the disinflation; 15. Greenspan's move to price stability; 16. International bailouts and moral hazard; 17. Monetary policy becomes expansionary; 18. Departing from the standard procedures; 19. Boom and bust; 20. Backing off from price stability; 21. The Volcker-Greenspan regime; 22. The Fed: inflation fighter or inflation creator?; 23. The stop-go laboratory; 24. Stop-go and interest rate inertia; 25. Monetary nonneutrality in the stop-go era; 26. A century of monetary experiments.

Copyright Date

2008

Item description from the seller

Seller assumes all responsibility for this listing.

eBay item number:186398050682

Shipping and handling

| Save on shipping. This seller offers shipping discounts on combined purchases for eligible items. |

Item location:

Ellinger, Texas, United States

Ships to:

Afghanistan, Albania, Algeria, Andorra, Angola, Anguilla, Antigua and Barbuda, Argentina, Armenia, Aruba, Australia, Austria, Azerbaijan Republic, Bahamas, Bahrain, Bangladesh, Belgium, Belize, Benin, Bermuda, Bhutan, Bolivia, Bosnia and Herzegovina, Botswana, Brazil, Brunei Darussalam, Bulgaria, Burkina Faso, Burundi, Cambodia, Cameroon, Canada, Cape Verde Islands, Cayman Islands, Central African Republic, Chad, Chile, China, Colombia, Costa Rica, Cyprus, Czech Republic, Côte d'Ivoire (Ivory Coast), Democratic Republic of the Congo, Denmark, Djibouti, Dominican Republic, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Estonia, Ethiopia, Fiji, Finland, France, Gabon Republic, Gambia, Georgia, Germany, Ghana, Gibraltar, Greece, Greenland, Grenada, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Honduras, Hong Kong, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, Kenya, Kiribati, Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Lesotho, Liberia, Liechtenstein, Lithuania, Luxembourg, Macau, Macedonia, Madagascar, Malawi, Malaysia, Maldives, Mali, Malta, Mauritania, Mauritius, Mexico, Moldova, Monaco, Mongolia, Montenegro, Montserrat, Morocco, Mozambique, Namibia, Nauru, Nepal, Netherlands, New Zealand, Nicaragua, Niger, Nigeria, Norway, Oman, Pakistan, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Qatar, Republic of Croatia, Republic of the Congo, Romania, Rwanda, Saint Kitts-Nevis, Saint Lucia, Saint Vincent and the Grenadines, San Marino, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Slovakia, Slovenia, Solomon Islands, South Africa, South Korea, Spain, Sri Lanka, Suriname, Swaziland, Sweden, Switzerland, Taiwan, Tajikistan, Tanzania, Thailand, Togo, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Turks and Caicos Islands, Uganda, United Arab Emirates, United Kingdom, United States, Uruguay, Uzbekistan, Vanuatu, Vatican City State, Vietnam, Wallis and Futuna, Western Samoa, Yemen, Zambia, Zimbabwe

Excludes:

Barbados, French Guiana, French Polynesia, Guadeloupe, Libya, Martinique, New Caledonia, Reunion, Russian Federation, Ukraine, Venezuela

| Shipping and handling | To | Service | Delivery*See Delivery notes |

|---|---|---|---|

| US $5.61 | United States | Economy Shipping (USPS Media MailTM) | Estimated between Thu, Jun 27 and Sat, Jun 29 to 43230 |

| US $13.60 | United States | Standard Shipping (USPS Ground Advantage®) | Estimated between Thu, Jun 27 and Sat, Jun 29 to 43230 |

| US $17.80 | United States | Expedited Shipping (USPS Priority Mail®) | Estimated between Tue, Jun 25 and Fri, Jun 28 to 43230 |

| US $65.05 | United States | Expedited Shipping (USPS Priority Mail Express®) | Estimated between Tue, Jun 25 and Wed, Jun 26 to 43230 |

| Handling time |

|---|

| Will usually ship within 1 business day of receiving cleared payment. |

| Taxes |

|---|

| Taxes may be applicable at checkout. Learn moreLearn more about paying tax on eBay purchases. |

Sales Tax for an item #186398050682

Sales Tax for an item #186398050682

Seller collects sales tax for items shipped to the following states:

| State | Sales Tax Rate |

|---|

Return policy

| After receiving the item, contact seller within | Refund will be given as | Return shipping |

|---|---|---|

| 30 days | Money Back | Buyer pays for return shipping |

Refer to eBay Return policyopens in a new tab or window for more details. You are covered by the eBay Money Back Guaranteeopens in a new tab or window if you receive an item that is not as described in the listing.

Payment details

Payment methods

Popular categories from this store

Seller feedback (1,781)

4***m (318)- Feedback left by buyer.

Past 6 months

Verified purchase

Items as described. Well packaged. Fast shipping. Smooth transaction. Good communication. Would do business with again.

-***3 (67)- Feedback left by buyer.

Past 6 months

Verified purchase

Items as described. Well packaged. Fast shipping. Smooth transaction. Good communication. Would do business with again.

r***r (498)- Feedback left by buyer.

Past 6 months

Verified purchase

Very happy with the book and the seller. Item was securely wrapped for shipping and the book itself was in great condition (even better than described). Very happy with the book and the overall transaction. Thank you to the sellers. I’ll be back to purchase more in the future! A+++

Product ratings and reviews

More to explore :

- History New Yorker Magazines,

- History Cycle News Magazines,

- History New Man Magazines,

- History Robert Louis Stevenson Antiquarian & Collectible Books,

- History Nonfiction Robert Louis Stevenson Hardcover Books,

- Robert L. Asprin Fiction Fiction & Books,

- Illustrated History Robert Louis Stevenson Antiquarian & Collectible Books,

- History Magazines,

- History Textbooks,

- History Antiquarian & Collectible Books